Financial investments made smarter.

Significantly more return for the same risk class. Sounds nice. True.

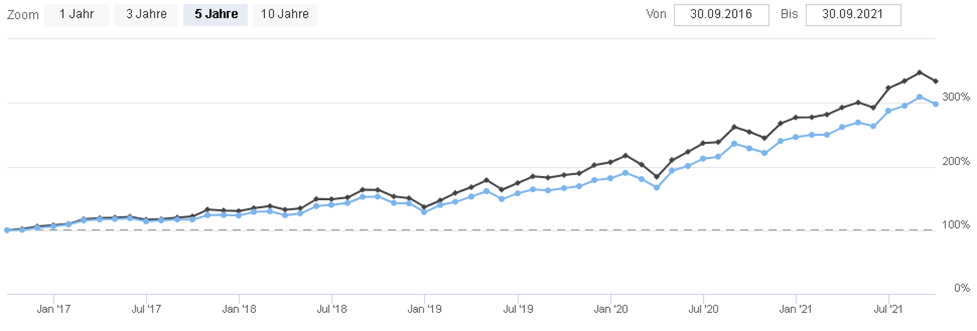

Smart Growth: 70-350% better performance.*

Smart Growth: 70-350% better performance.*

We take your deposit and ensure the best possible results with basically identical investment and thus risk classes. We take care of the cost-effective leveraging, the global asset allocation to passive index funds, so that your deposit works for you several times over. And it is important to know that we invest our own capital in the same financial assets, so we are convinced of what we are doing and are in the same boat from an investment point of view.

and significantly so, due to procedural and algorithmic excellence of human experts combined with intelligent systems.

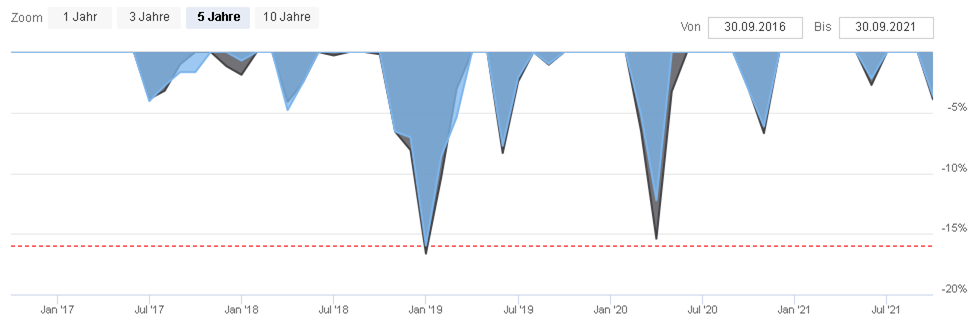

Due to the levers applied with basically identical risk classes, we already double the managed deposit (before costs) after 5 years, unlike pure or hybrid digital advisors, which are projected in a range of 30-50% after 5 years.

The most experienced specialists from the data science and finance environment determine the best performance opportunities based on algorithms.

We use the best approaches and results from the financial world and furthermore intelligently combine Robo Advisory recommendations.

Since the end of the 1990s, we have had experience in successful financial investment with principally* low risk classes and high performance. We know financial crises and have successfully mastered them. This knowledge is now available to selected clients, who can also use the best online brokerage tools, but do not have to (we take care of the performance).

Our offer is not for everyone, but only for a selection of clients who fit our approach as a specialised boutique and are fundamentally robust enough to really generate better returns, which are of course marked by the usual volatilities. We don't gamble here, but leverage intelligently, planfully and cost-efficiently (50-300%).

We respect all intelligent approaches, analyse them, draw scientifically sound learnings and adapt our own algorithms to achieve very good results on a secure basis.

This mutual suitability must be clarified in advance. Here, however, it is primarily a matter of your personal suitability, in order, of course, to comply with the legal provisions for investment brokerage.

This is where we answer the question of whether and how our approaches fit your knowledge and experience. This means that after a few short iterations it becomes clear whether it makes sense for both sides to work together.

Let's go. In short: we discuss the final procedure, take care of the leveraging and the execution of the orders and adapt the assets if necessary, depending on the market situation. Then it's a matter of enjoying the portfolio's performance with a robust basic attitude. We take care of all the necessary operational activities for you.

Great! Then let us check whether we are a good fit for each other - according to the motto: Everything can, nothing must. Simply contact us free of charge and without obligation. We will check the suitability together and can then explore a cooperation.

Two small tips:

Fits for you?!